June 27, 2018

“We don’t have a lack of capital in the U.S. We have a lack of connectivity. We have a matching problem. This incentive might accelerate our ability to match up.”

-Bruce Katz, Co-Founder, New Localism

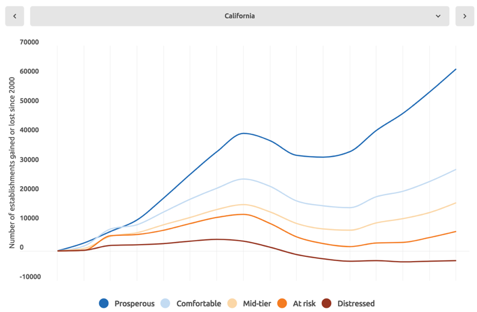

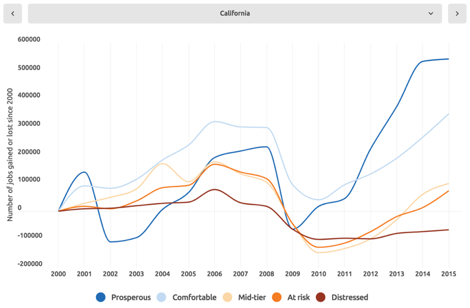

Following the 2008 recession, we have seen uneven recovery. Some communities have experienced business and job growth while others are falling further behind. From 2011 to 2015 distressed communities lost an average of 6% of their jobs and businesses, while more prosperous communities gained jobs and businesses by double-digit percentages, according to recent research.

At the same time, federal and state budgets are stretched thin, and communities are increasingly dependent on private investment for revitalization and economic development.

Meanwhile we’ve experienced historic growth of the stock market over the past decade, which has resulted in roughly $6.1 trillion in capital gains, according to the latest estimates from the Economic Innovation Group. Access to capital, however, is uneven and highly concentrated in a handful of metropolitan areas along with high-wage job growth.

Whole swaths of the country have seen a decline in banks lending to small businesses or opening new branches. Nearly 1 in 4 community banks have closed since 2008, and small-business lending remains down by one-quarter. Seventy-five percent of all venture capital is concentrated in three states (California, New York and Massachusetts). Philanthropy and foundations also bypass some of the neediest counties.

New Investment Tool for Community Projects

Fortunately, cities have a new financial and community development tool to tap into this capital and encourage revitalization in the poorest urban, suburban, and rural communities across the nation.

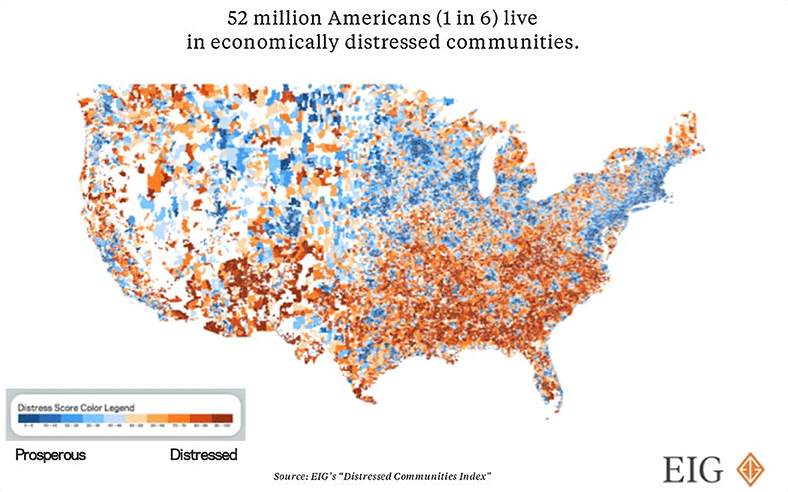

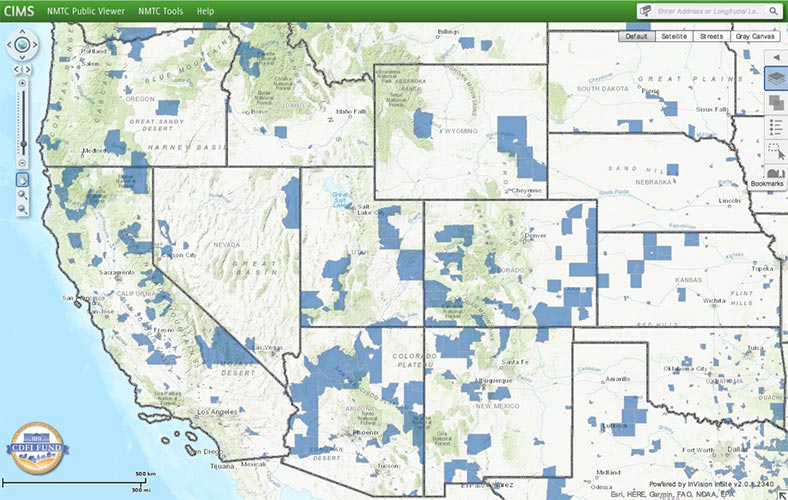

Opportunity Funds, created in the federal tax bill (H.R. 1) and signed into law in December 2017, could unlock private capital to facilitate economic growth in distressed areas.

Opportunity Funds are broad and flexible— they can fund a range of project types, including affordable housing, real estate, infrastructure, energy assets, existing or start-up businesses, innovation districts, brownfield redevelopment, and even transit.

Opportunity Zones were designated by individual states. The law allowed for 25% of a state’s low-income community population census tracts to be designated as qualified Opportunity Zones. Governors identified the areas in their states to be designated as Opportunity Zones for the next decade.

The designated Opportunity Zones (according to Smart Growth America):

- Account for 10% of America’s land mass.

- Are home to 30 million Americans, 60% of whom are demographic minorities.

- Have a 30% poverty rate and house residents earning, on average, 59% of AMI (Area Median Income).

- Employ 73% of residents in commercial jobs and 27% in industrial ones.

Additionally:

- Only 8.5% of already-designated Opportunity Zones have at least one transit station.

- 45% are located in rural census tracts, 33% in urban, and 22% in suburban.

- On average, residents spend 53% of their income on housing and transportation in these zones.

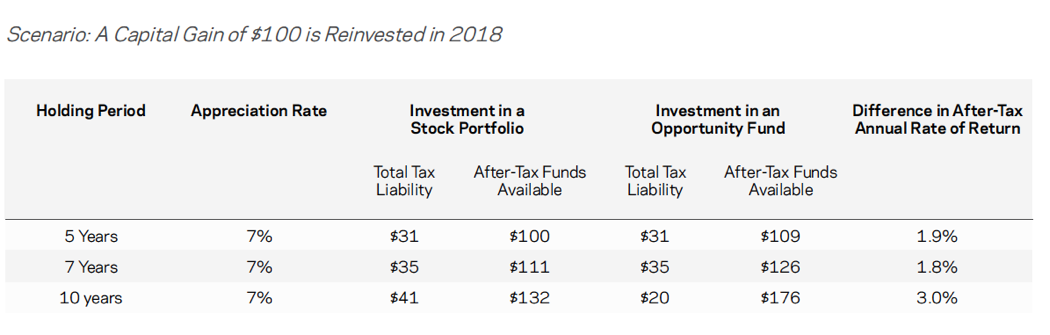

The incentive works by allowing individual or corporate investors to defer their capital gains on investments in opportunity funds for up to nine years. Long-term community investment is incentivized – investments for a period of at least 10 years are exempt from any additional gains beyond that which was previously deferred.

For investment held at least five years, the taxpayer’s basis is increased by 10% of the original gain. For investments held for at least seven years, the taxpayer’s basis is increased by 5% of the original gain.

Cities, suburbs, rural enclaves and regions can establish their own Opportunity Funds to identify needs ranging from hyper-local (small businesses) to intra-state (transit).

Opportunity Funds can be organized in various ways to raise capital from a wide array of investors if certified by the U.S. Treasury Department.

The promise of Opportunity Zones is that communities can identify and highlight their assets and signal their potential to investors. The program could deliver vital investment to underserved areas, but it could also fuel sprawl and gentrification in those communities where too much opportunity, too fast, has led to rapid displacement. A tax incentive for investors to build up areas where investors are already building, could also have negative community consequences.

Taking Steps to Take Advantage of Opportunity Funds

While the Treasury Department creates Opportunity Fund guidelines, local leaders should act now to identify investable assets, determine how to manage the inflow of capital, develop strategies to attract interested investors and protect existing residents and businesses.

Cities can inspire investor confidence by operating Opportunity Funds and lowering their risk profiles. Smart Growth America and LOCUS, a national coalition of real-estate developers and investors who advocate for sustainable communities, recommend local governments take the following steps:

- Designate staff to serve as a one-stop-coordinating office and point of contact for interested investors and businesses (open data, investment strategy, reporting).

- Establish state/city-based Opportunity Funds by pooling existing community development dollars to attract diverse equity partners, including public employees, local pension funds and crowdsourced funders.

- Provide incentives to encourage the formation of equitable Opportunity Funds.

- Institute “do no harm” policies (such as inclusionary-housing requirements) that protect vulnerable populations and existing businesses.

- Create strategic-investment plans and public-benefits strategies for Opportunity Zones:

- Develop a comprehensive, investable project pipeline that creates long-term housing and transportation affordability, while also accelerating job creation.

- Institute an inclusive community-engagement process for selecting projects and initiatives.

- Establish performance-based metrics, such as equitable-development scores, to ensure that Opportunity-Funded projects are positively improving lives and transforming places.

Prosperity in the 21st century will be based on creating and maintaining a sustainable standard of living and a high quality of life for all. To meet this challenge will require recognizing the economic value of natural and human capital.

While each community and region has unique challenges and opportunities, embracing economic, social, and environmental responsibility will be critical for building prosperous and livable places. The Ahwahnee Principles for Economic Development can provide a strong framework for local governments to prioritize projects, establish metrics, and create policy protections to ensure that Opportunity Funds align with community goals.

Resources

- Ahwahnee Principles for Economic Development

- LOCUS Opportunity Zone Navigator is an interactive mapping tool that allows users review the economic, environmental, demographic, housing and infrastructure characteristics of a designated Opportunity Zone census tract, and in turn, the type of development that will maximize public and private returns on investment and benefit residents.

- New York Times,”Tucked Into the Tax Bill, a Plan to Help Distressed America“

- EIG factsheet

- State of California Department of Finance, Opportunity Zones

- U.S. Department of the Treasury, Resources for Opportunity Zones

- Novogradac and Company, LLP, Opportunity Zone Resource Center