January 28, 2020

Topic

As the impacts of climate change – and their costs to communities – increase, the urgency to integrate resilience initiatives into our budget processes likewise continues to grow.

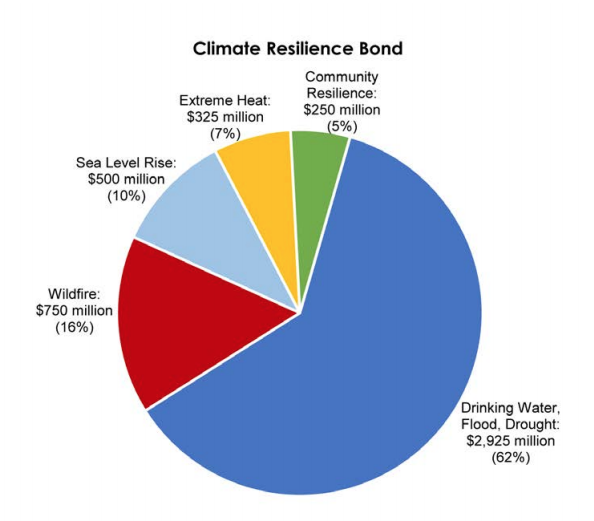

Earlier this month, Governor Newsom proposed a $12.5 billion climate budget (as part of the state budget) to be rolled out over five years, including the Greenhouse Gas Reduction Fund ($965 million from cap-and-trade), $1 billion in general fund dollars for a “Climate Catalyst Fund” for low-interest loans for climate-related projects, and a $4.75-billion climate resilience bond that the governor hopes to put in front of voters in November to help reduce risks from water, fire, extreme heat and sea-level rise.

The climate budget includes $66 million for reducing flood risks, $51 million to speed up the deployment of electric-vehicle infrastructure and $103 million for water resiliency.

The budget includes more than a billion dollars for emergency preparedness and wildfires. More than $110 million would go to a home-hardening pilot focused on low-income communities in fire zones.

The budget also lays out $53 billion toward infrastructure, with more than 75% going to transportation, a sector which makes up 40% of California’s carbon emissions.

This type of investment is needed at the local level as well. Communities can take a number of steps to align their budgeting process with climate goals and risks. Energy Cities recommends that jurisdictions focus on five key areas: environmental reporting and budgeting; green public procurement; divestment of municipal funds from fossil fuels; green municipal bonds; and earmarking local revenues and other financial instruments.

Environmental reporting and budgeting: Climate is money

We need to change the way municipal budgets are presented to account for climate impacts and the costs needed to attain city and county climate goals. Combining environmental with financial reporting leads to better-informed decision-making about investments and fund allocation.

Oslo. In Norway, the Oslo City Council adopted its first Climate Budget in 2016. The Climate Budget provides an overview of 36 measures to achieve Oslo’s climate goals. CO2 emissions and the costs of reducing them are reported at the same time as the regular budget report, thus making the Climate Budget an integral component of the overall city budget.

Reports on the Climate Budget are presented during the three key steps of the budget cycle during budget planning, when the budget is proposed to the City Council, at the end of the year before planning begins for the next budget cycle. By specifying the costs and timeframe for all the measures it includes, there is greater transparency on what the city is doing to achieve its objectives.

Paris. An annual ‘Bleu Climat Energie’ report is adopted by the Paris City Council at the same time as the preliminary annual budget, as a way to follow up actions in the Climate and Energy Plan and indicate budgetary, energy and emission savings that have been achieved through these actions. Linking extensive environmental reporting to the budget planning phase is used to align investments with the advancement of climate and energy actions, as well as to account for the additional costs and savings from these actions.

Växjö, Sweden. Växjö appointed an ecoBudget manager, who presents a report to the City Council every six months to take appropriate measures in case that a target might be missed, dealing with events not budgeted for, and keeping politicians informed about budget implementation. The environmental and financial budget reports were integrated into a single document and approved by the City Council at the same time.

Green public procurement: Buying can be climate-smart

Municipal procurement budgets represent a significant opportunity to leverage sustainable and innovative market practices. City staff has to engage with the local economic actors to ensure that their environmental standards are being met, and better understand what is possible in today’s market.

Copenhagen. All of Copenhagen’s agencies are required to integrate environmental and climate requirements in their procurement. A ‘Team Green Public Procurement’ works across all procurement units to provide support for sustainable procurement and market engagement activities involving environmental and climate issues.

Rome. The Metropolitan City of Rome Capital has linked a digital monitoring system for green public procurement (GPP) to its e-procurement platform since 2016. Rome developed its first action plan for green procurement in 2009, which established a manual monitoring system, requiring procurement staff in each department to send a form to the GPP Coordination Office whenever they completed a green purchase. The action plan also set up a Green Purchasing Workgroup to promote sustainable development. GPP reduced CO2 emissions by an estimated 749 tons from 2011 to 2014.

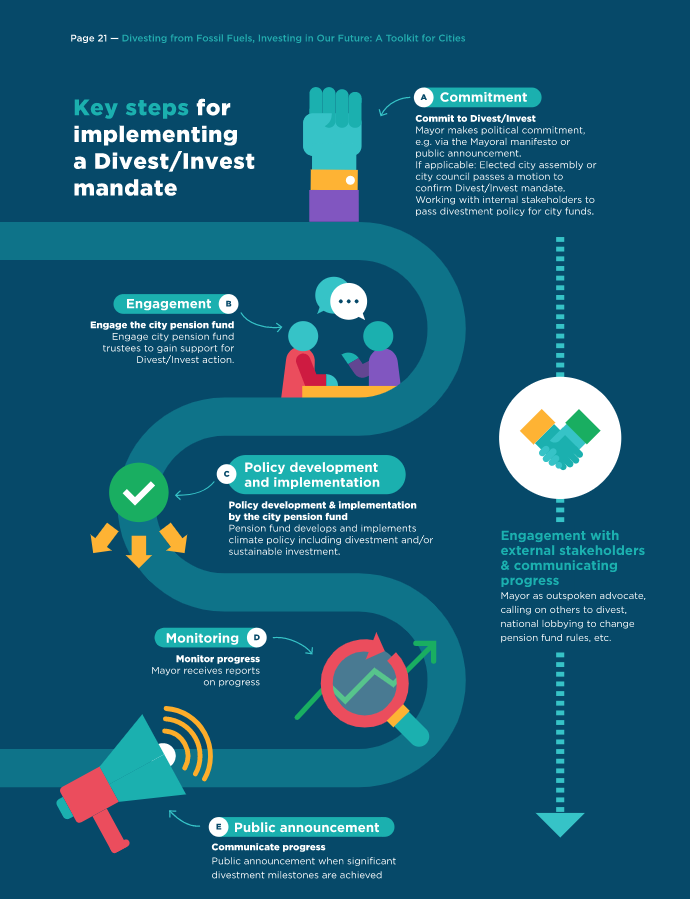

Divesting fossil fuels: Moving our money into clean solutions

Local authorities need to be demanding in the relationships with their banks and fund managers – urging transparency about how these financial-service providers manage the City’s money in terms of environmental-investment criteria and climate risk.

New York City. New York City was the first city in the U.S. to set in motion a comprehensive divestment and investment strategy as part of their Green New Deal to achieve carbon neutrality by 2050. In January 2018, Mayor Bill de Blasio announced that New York City will fully divest from fossil-fuel reserve owners by the end of 2022.

The trustees for three of the five pension funds with assets of around $130 billion agreed to determine a “prudent strategy that responsibly reduces the portfolio’s exposure to carbon risk in general and specifically to fossil fuel owners’ securities.”

The New York City Comptroller is taking the lead in the development of the strategy and is currently commissioning independent advice on the options for implementation. The advisor will further evaluate risks and look at different strategies for divestment.

In September 2018, the Mayor, Comptroller and pension-fund trustees also announced a new goal to double the investments of the City’s pension funds in climate-change solutions to $4 billion, or 2% of its $195-billion pension portfolio over the next three years.

Green municipal bonds: Raising money for climate-smart projects

A green bond is one whose issuer commits to using 100% of the proceeds for eco-friendly purposes. Municipalities can use green bonds to fund renewable energy, clean transportation, sustainable water-management or climate-adaptation projects for example.

Green bonds can also be an opportunity for a city to develop capacity-building among environmental staff, extend cooperation by breaking down silos, and implement monitoring and reporting mechanisms, to help stay on top of the climate impacts of their investment projects.

The U.S. municipal bond market encompasses 2,083 “green” municipal bonds (according to Bloomberg), and another 643,299 ordinary municipal bonds, issued between 2010 and 2016. The annual issuance of bonds identified as “green” rose from less than $500 million a year (or less than 0.18% of the total municipal issuance) in 2010 to 2013 to over $2 billion in 2014, and reached $6.5 billion (or 1.9%) in 2016.

San Francisco. The City of San Francisco used a climate bond to finance “The Transbay Transit Center Program” to increase transit use through intermodal connections for eight Bay Area counties and the State of California through eleven transportation systems. The proceeds have been used to finance a new 1-million square-foot Transbay Transit Center in the downtown – with a 5.4-acre Rooftop Park on top of the center that will also double as a green roof.

Paris. The City of Paris has issued two green bonds: 300 million euros and a 1.75% interest rate in 2015 and 320 million euros and a 1.423% interest rate in 2017. The green bonds can be renewed every year, allowing new money to be raised for more projects. Paris was successful in getting more than 30 investors involved into its green bond. More than 150 projects are selected on the basis of the City’s ‘Plan Climat-Energie.’ The projects financed through the green bonds must cover at least one of the four objectives of Paris’ climate plan: reduction of GHG emissions, reduction of energy consumption, production of renewable-energy or energy-recovery systems, and climate adaptation.

Earmarking local revenues and other financial instruments

Several cities have used environmental taxes to create funds for energy-efficiency or sustainable-transportation projects. Through such taxes or even more innovative financial tools such as carbon-offsetting, local officials can raise awareness among citizens and companies of the need to change habits and mobilize their resources to invest in energy and climate projects.

Milan. In northern Italy, Milan implemented a traffic congestion charge effective in 2012, charging 5 euros on workdays between 7:30 am and 7:30 pm for all vehicles entering the central ring. Electric and hybrid vehicles have free entry, while the highest emitting vehicles (petrol pre-euro, diesel pre-euro and Euro I and II) are completely banned from the area.

Revenues from the congestion charge are earmarked for sustainable-mobility projects. So far, they’ve financed a new Park and Ride system connected to the metro (3.8 million euros), bike-sharing improvements (3 million euros) and transit improvements through fleet renewal and increased frequency (10 million euros). The results after just one year of operation included a decrease of 31% in traffic and a 49% decrease in high-polluting vehicles.

Lausanne. In Switzerland, municipalities are “entitled to levy specific, transparent and clearly defined municipal taxes to support renewable energies, public lighting, energy efficiency and sustainable development.”

The City of Lausanne collects two different taxes per kWh consumed in every household, which are then fed into two funds, one earmarked for energy efficiency and one for sustainable development in general. The amount of the taxes is determined from year to year.

For 2018, both the energy efficiency tax and the sustainable development tax are set at 0.3 ct/kWh each (compared to 0.25 ct/kWh in 2017). The taxes are levied directly by the grid operator and included on the customer’s electricity bill, and then the amounts are transferred to the municipality. In addition to the electricity tax, there are other taxes on gas sales by the Gas and District Heating Service (0.1 ct/kWh) and water sales (3 cts/m3), which feed into the sustainable development fund.

Alameda County. In the East Bay, Alameda County has also implemented a utility bill surcharge for all County departments that funds an energy office to oversee the planning, implementation, financing and tracking of the energy and fiscal impacts of projects.

Go green, save green

Given the increasing awareness of the urgent need to address climate change, cities and counties should be pursuing similar measures to better align their budget, investment and procurement processes to ensure that their local investments are supporting community resilience that will pay off for generations to come.